What Spokane Rental Owners Need to Know About the Multi-Family Market – May 2025

Every month, we track multi-family market trends across Spokane. As a full-service Spokane property management company, we stay on top of the data to better support our clients. Here’s what we uncovered in May compared to April’s activity.

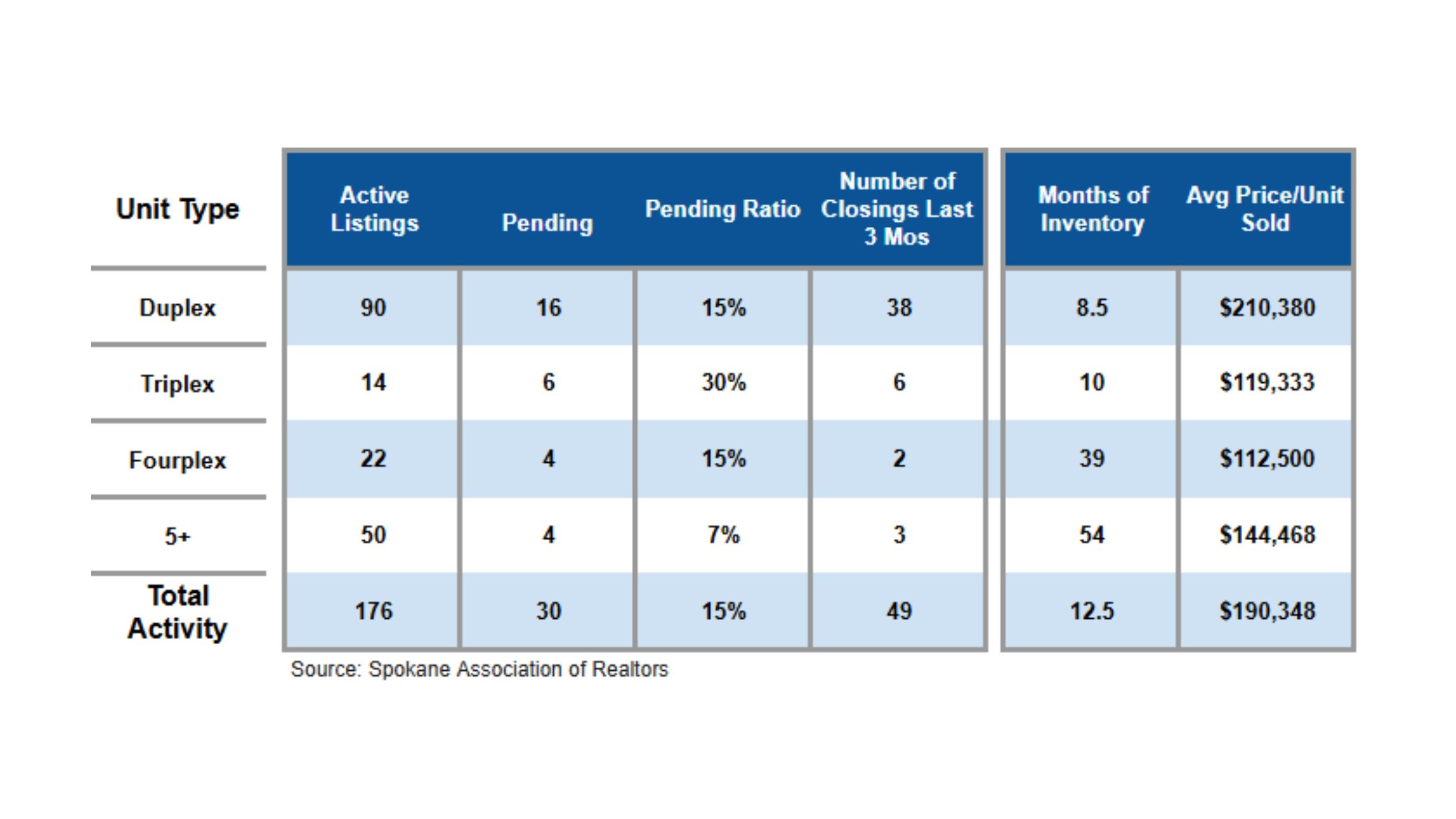

Key Takeaways: April vs May

Duplex Sales Dropped (53% Decline):

Duplex closings dropped from 38 in April to 18 in May—a steep 53% decline. There are still 16 duplexes pending, but fewer closings point to shifting buyer behavior.

Duplex Prices Dipped ($210,380/Unit):

The average duplex price fell 9.5% month-over-month, from $232,326 in April to $210,380 in May.

Increased Duplex Inventory (8.5 Months):

With 90 active listings and 8.5 months of inventory, duplexes remain relatively well-supplied, leaning toward a buyer's market. Inventory is increasing at a higher rate compared to single family properties for sale.

Triplexes Gain Traction (30% Pending Ratio):

Triplexes saw 6 of 14 listings go pending, yielding a 30% pending ratio—indicating healthy demand and quicker movement than other segments.

Larger Units Struggle (High Inventory, Low Sales):

Fourplex and 5+ unit properties saw low sales volume (2 and 3 closings, respectively), while inventory remains high—39 months for fourplexes and 54 for 5+ unit properties. These segments are still oversupplied and face slow turnover.

What This Means for Spokane Rental Owners

Investor interest remains, but we’re seeing a market correction play out. Duplex owners are adjusting pricing, and triplexes show more competitive demand. Larger multi-family properties face longer hold times and steeper price negotiations due to excess inventory.

At Cobalt Property Management, we use data-driven strategies to help Spokane rental owners stay ahead. Whether you’re buying, selling, or optimizing your portfolio, we’re here to guide you through every market turn.

If you own rental property in Spokane and want strategic insight, reach out today. Let’s create a plan to help your investments perform at their best.